VantageOne Credit Union is committed to supporting our business members through this difficult time. We are pleased to announce that we are now accepting applications for the federal government’s Canada Emergency Business Account program for non-deferrable expense-based businesses (CEBA 3.0).

Program Eligibility:

- The Borrower is a Canadian operating business in operation as of March 1, 2020.

- The Borrower has a federal tax registration.

- For applicants with Cdn.$20,000 or less in total employment income paid in the 2019 calendar year:

- The Borrower has a Canada Revenue Agency business number and has filed a 2018 or 2019 tax return.

- The Borrower has eligible non-deferrable expenses between Cdn.$40,000 and Cdn.$1,500,000. Eligible non-deferrable expenses could include costs such as rent, property taxes, utilities, and insurance. Expenses will be subject to verification and audit by the Government of Canada.

- The Borrower has an active business chequing/operating account with VantageOne Credit Union, which is its primary financial institution. This account was opened on or prior to March 1, 2020 and was not in arrears on existing borrowing facilities, if applicable, with the VantageOne by 90 days or more as of March 1, 2020.

- The Borrower has not previously used the Program and will not apply for support under the Program at any other financial institution.

- The Borrower acknowledges its intention to continue to operate its business or to resume operations.

- The Borrower agrees to participate in post-funding surveys conducted by the Government of Canada or any of its agents.

- The Borrower must also agree to participate in post-funding surveys conducted by the Government of Canada or any of its agents.

The Eligible Non-Deferrable Expense Categories are the Following:

- Wages and other employment expenses to independent (arm’s length) third parties;

- Rent or lease payments for real estate used for business purposes;

- Rent or lease payments for capital equipment used for business purposes;

- Payments incurred for insurance-related costs;

- Payments incurred for property taxes;

- Payments incurred for business purposes for telephone and utilities in the form of gas, oil, electricity, water and internet;

- Payments for regularly scheduled debt service;

- Payments incurred under agreements with independent contractors and fees required in order to maintain licenses, authorizations or permissions necessary to conduct business by the Borrower.

CEBA 3.0 Application Process

Businesses with annual payroll less than $20,000 during 2019 and eligible non-deferrable expenses for 2020 projected to be between $40,000 and $1.5 million, can apply via a 2-step process.

Step 1: Initiate an application through VantageOne

- Log in to your Member Direct Small Business online banking

- Click on Account Services

- Then click on the CEBA button

- Start your application for CEBA 3.0

- IMPORTANT NOTES

- Corporations – required to supply VantageOne with most recent T2

- Sole proprietors & Partnerships – required to supply VantageOne with most recent T1

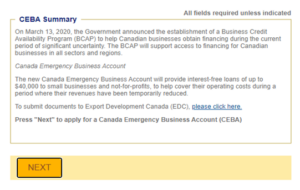

- In the application in the screenshot below, please DO NOT hit NEXT, before you have submitted your documents to the EDC through the please click here link.

Step 2: Upload evidence of non-deferrable expenses via the Government of Canada’s CEBA website for verification.

To complete this application process, members will need to have:

- a 9-digit CRA Business Number;

- the ability to provide verifiable business information from their most recent CRA business tax filing (2018 or 2019); and evidence of eligible non-deferrable expensesOpens a new window in your browser. for 2020, like commercial leases, property tax statements or utility bills, to upload to the federal government’s website

More information is available on the following sites:

More information: https://ceba-cuec.ca/

Application: https://application-demande.ceba-cuec.ca/

Funding Timelines

Please be aware, the CEBA 3.0 version has more complexity in the application process and the actual processing time – from application to receiving funds takes more time. The Government of Canada has advised us to expect a 15 business day turnaround from when you submit your application.

Remember, the Commercial Department of VantageOne Credit Union is here to help. Please reach out to us for any support you require!

– The VantageOne Commercial Department

|

Earn 50% More Rewards on Your VantageOne Credit Card

Earn 50% More Rewards on Your VantageOne Credit Card